21 Jan Back to basics…

What is value-added?

Is value-added different to output?

Are wages part of value-added?

We are often asked questions like the ones above by our clients who are looking to further clarify how to interpret some analysis or reporting provided in REMPLAN. What is meant by the terminology used in economics is not always immediately apparent if you don’t live and breathe it every day ….like us! This post is a bit of ‘101’ in economic terminology.

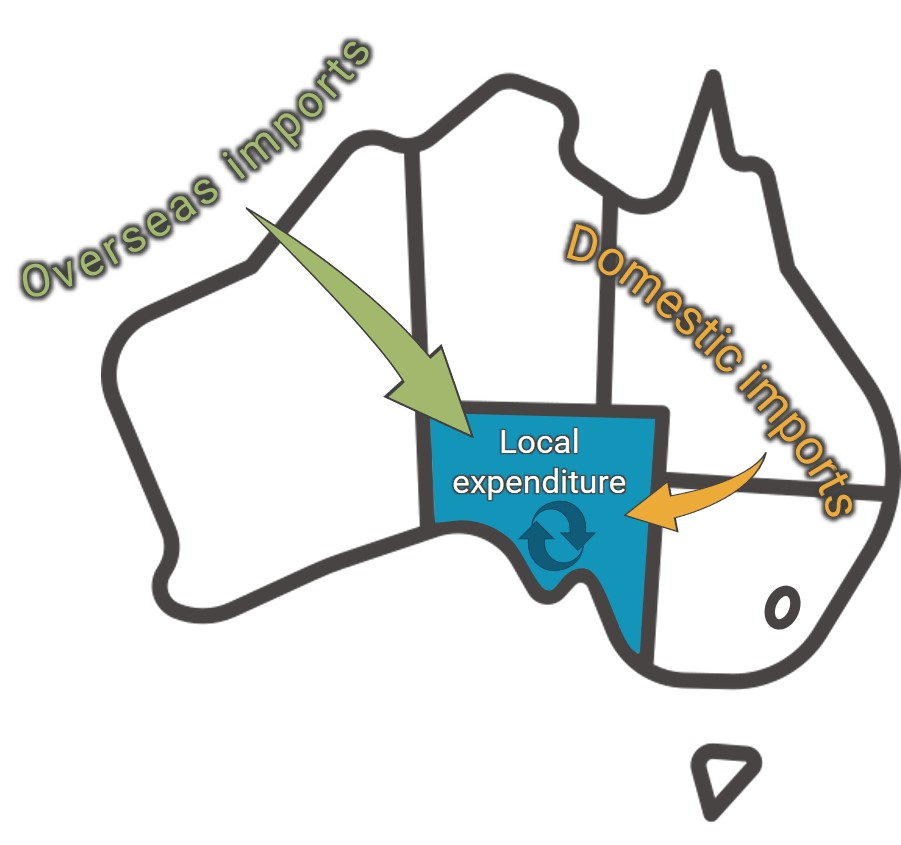

We will break down ‘output’ into its respective parts and this should give you a better understanding of where everything sits in the scheme of things. The image below is a simple representation of the components of output and how all the parts fit together.

But before we get in to it, it will be good to get our heads into the right space. While we often talk about ‘the economy’ and values in the millions or billions, these terms can be a bit difficult to relate to. To put things into a more relatable context, we can look at output from the level of a business. After all, the economy is made up of industries which are in turn just a collection of businesses and organisations. So, to simplify things, we will put all this into the context of a business that has just sold an item for $100.

Output

Output is the big one! It is an overarching economic metric which includes all other metrics. Think of this like total income or total sales. So, if a business sells an item for $100, it has generated $100 of output.

Inputs into production

Inputs are all the things that are purchased from other businesses that are then used to generate output / revenue. So if a business made its $100 sale, it may have spent $55 on inputs. This could include various materials it has purchased from nearby businesses or from overseas, transport costs and even a portion of other operating expenses such as insurance or accounting services.

Inputs can be broken into three different categories depending on where they were sourced: local, domestic and overseas.

Local inputs

Locally sourced inputs are termed ‘local expenditure’.

In economics, like many things, geography matters. What is ‘local’ is different depending on where we are talking about. If we are talking about the economy of South Australia, then ‘local’ is within South Australia. But if we are talking about the economy of Port Augusta, then local expenditure is the expenditure on inputs that are sourced only from Port Augusta.

Domestic inputs

Inputs that are sourced from outside of the ‘local’ region but still within Australia are called ‘Domestic imports’. Remember, this can include goods AND services. So if our business that sold the $100 item is located in Port Augusta and uses an accountant from Whyalla, then they are importing services which is a form of domestic import.

Overseas inputs

…and inputs from overseas are ‘overseas imports’. Simple!

Value-added

Value-added is a really important metric as it is non-duplicative (more on that in another post, or just Google it if you are impatient) and is the major element in the calculation of Gross Domestic / State / Regional Product. So when you hear politicians or economists on the news talking about GDP growth or decline, the bulk of that figure is made up of value-added by industries. “And why is this esoteric concept important?” I hear you say. Well GDP is a readily accessible figure that allows us to measure the economic health and wealth of one region and compare it to another.

Value-added represents just what it says; the marginal economic value that is added by an industry (or business) to the costs of inputs. So if our business spent $55 on inputs for its $100 sale, then it has created $45 of value-added.

Value-added = Output minus (local expenditure + domestic imports + overseas imports)

But that $45 doesn’t go straight into the pocket of the business. There are a few things that need to be accounted for as wages aren’t included as an input into production and we haven’t paid the tax man!

So a good way to think about value-added is as income:

- income for individuals (wages and salaries)

- income for businesses (gross operating surplus) and

- income for government (net taxes on production, products and services)

Hopefully this article has helped with understanding how these terms that are often used in economics relate to each other. So next time you do some economic impact modelling in REMPLAN, you will know that the impact on value-added includes the impact on wages and salaries. Or if your manager needs to know what the value of imports into your region are, you can demonstrate your knowledge in economics and clarify if they want the figure for domestic imports or overseas imports.

One final note. In this article we have looked at the component parts of output using the ‘income method’. But there is more than one way to skin a cat, and of course there is more than one way to skin an economic term. We can also calculate output (and GRP for that matter) using the ‘expenditure method’. But we have covered enough, so it is probably best to leave that for another day!

No Comments