04 Dec Risk versus Reward

Evidence based decisions about where to live, work and invest.

Matthew Nichol – Principal Economist, REMPLAN

November 2020

“The biggest risk is not taking any risk… In a world that’s changing really quickly, the only strategy that is guaranteed to fail is not taking risks.”

Mark Zuckerberg

The motives that drive people to consider moving to or investing in a new area are varied. The consideration of such a decision is one thing, to act another. When planning a move or investment there are a myriad of questions that need to be addressed.

For businesses and investors such questions include:

- Will I be able to find workers with the requisite skills and experience?

- Are local supply chains complementary to my business?

- Does the area have enabling infrastructure and services (e.g. transport, telecommunications)

- Are sites / premises available in suitably zoned areas?

- Is the area’s population and economy growing?

- Is there a pipeline of future projects and developments?

- Are other businesses investing in this area?

- Should I buy or lease property here?

From the perspective of individuals:

- What are the local employment opportunities for other family members?

- Does the area offer a range of education and training opportunities?

- Are health services available?

- What recreational activities exist and is there open space?

- Is there public transport?

- Are other people moving here (i.e. is the area growing)?

- What’s the age profile (e.g. many young families, retirees)?

- What are the other demographic characteristics of residents (e.g. educational attainment, occupations, incomes)?

- Levels of social disadvantage?

If the answers to some or all of these questions is ‘I don’t know’ then the perception of risk for prospective businesses and individuals will be high. Where risk is high, the confidence to buy a house or invest in an area is likely to be lower.

When businesses raise capital to invest, a person accepts a job offer in another city, or takes out a mortgage to buy a house, their acceptance of risk reflects their confidence in the future and the decision they are making.

What is the basis for confidence and optimism that the future will deliver positive outcomes?

The levels of risk people are willing to accept vary from person-to-person. Human beings each have their own uniquely calibrated scale for weighing the balance of risk versus a likely future reward.

Information, such as answers to the questions posed above, allow us to recalibrate the balance between risk and reward and help us have the confidence to invest and make decisions today that we predict will deliver benefits for us in the future.

When seeking to address a question such as ‘Should I buy a house here, or rent?’ it is also important to unpack the real questions that are hidden behind this:

- If I buy, then need to sell, will it sell quickly?

- Will I lose money?

While no one can answer these questions for you definitively, information is available to help you assess the likely risk. For example:

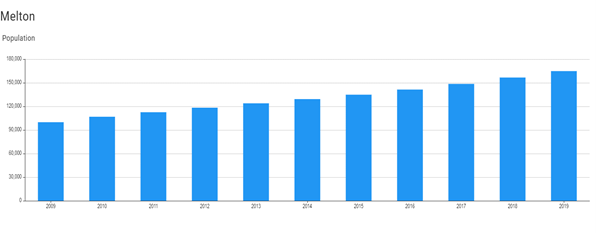

A steadily growing population is likely to indicate strong demand for housing.

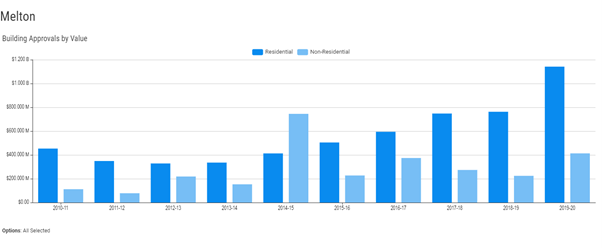

Residential building approvals is an indicator of forward activity as most of the approved dwellings will subsequently be built in coming years.

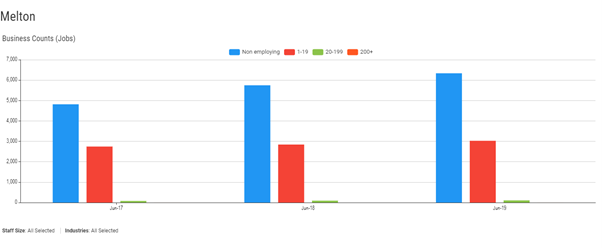

Rising business counts is likely to reflect confidence in the area and its economy.

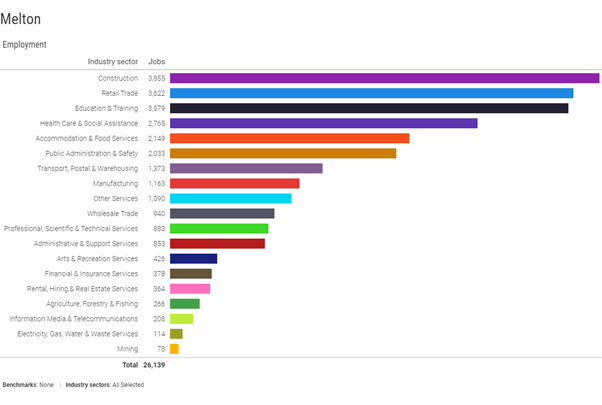

A diverse employment base indicates that that the region is likely to be resilient to external shocks and events. The structure of an area’s economy has some parallels with a share portfolio.

“Diversification helps you ride out the ups and downs of financial markets by spreading your money across different asset classes. It will leave you less exposed to a single economic event, so if one business or sector you’ve invested in isn’t performing well, you won’t lose all your money .”

www.moneysmart.gov.au

In addition to the above public-access resources, REMPLAN and Melton City Council can support local businesses and prospective investors via their access to REMPLAN software with detailed local data and analytical resources to support local businesses. These resources provide a range inputs to assist businesses with:

- Site selection based on land use zones, travel times and access to workers, services and infrastructure

- Economic impact analysis (jobs, wages, output, value-added) for grant and planning applications

- Business case preparation

- Tourism and event analysis

- Home-based business analysis

- Monitoring new business start-ups by industry sector and location.

REMPLAN prepares population and employment forecasts and monitors the demography of communities and local economies for all Australian regions, local government areas, towns, suburbs and activity centres. REMPLAN also works directly with businesses in relation to the preparation of business cases, planning matters and funding submissions.

Questions? Contact the team at REMPLAN: 1300 737 443

Related topics

Industrial Land Supply and Demand Modelling

No Comments